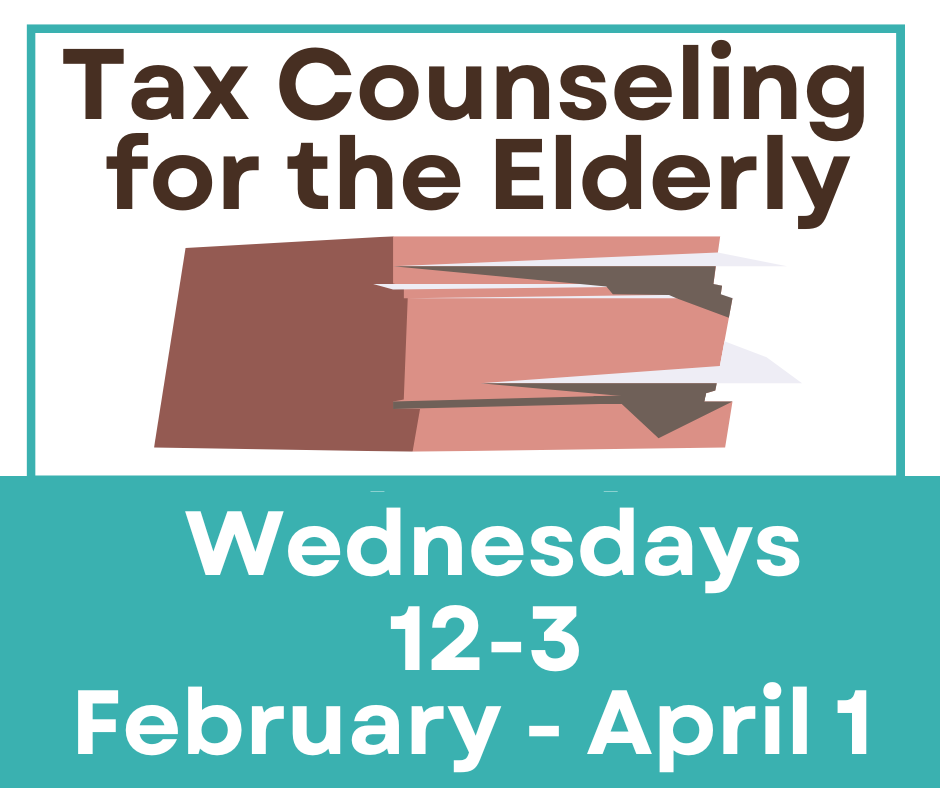

Wednesdays, February 4, 2026 -April 1, 2026 12:00pm-3pm, weather permitting, get help with your 2025 tax returns, DROP-OFF your tax documents with a Finger Lakes Community Action Volunteer (WayneCAP) at OPL/Town Meeting Room.

Bring with you to your DROP-OFF: If you are married filing jointly, both spouse must be present

- Copy of your previous year tax returns

- Proof of Identity for all individuals on the tax returns (Driver’s License or other government issued photo ID)

- Social Security cards or Individual Taxpayer Identification Number documents for you, your spouse and/or dependents

- Birthdates for you, your spouse and/or dependents

- All forms, W-2 and 1099

- Forms 1095-A, B, or C (ACA statements)

- Information for other income

- Total paid to day care provider and their tax Identification number

- Information for all deductions (including charitable contributions)/credits

- For direct deposit of refund, proof of account and bank’s routing number (e.g.voided check)

- For prior year returns, copies of income transcripts from IRS (and state if applicable)